In Australia's cut-throat rental market, a proper tenant screening background check is your best line of defence. This isn't just about ticking off boxes on a form; it's about actively protecting your investment from the all-too-real risks of rent defaults, property damage, and eviction sagas that can drag on for months.

Frankly, it's the bedrock of a stable, profitable rental business.

Why a Solid Screening Process Is Non-Negotiable

Making a leasing decision based on hard data—not just a "gut feeling"—is the single most important thing you can do to manage risk as a modern Aussie landlord. Skipping this step or cutting corners is a surefire way to invite financial and logistical headaches into your life. A thorough background check gives you the objective facts you need to pick a reliable tenant who’ll pay their rent on time and actually look after your property.

This has never been more critical, especially with how ridiculously competitive Australia's rental market is right now. The intense demand and chronic low supply mean landlords are often buried under dozens of applications for a single listing.

Take Sydney’s inner west, for example. In early 2024, the vacancy rate was a staggering 0.8%, which pushed the median rent for a two-bedroom apartment past $750 a week. You can dig into more data on Australia’s tight rental market in recent reports. When you're facing that much competition, diligent screening is the only way to effectively filter through the noise and pinpoint the best applicants.

Secure Your Investment and Your Sanity

At the end of the day, the goal here is to protect your asset. A bad tenant can easily cause thousands of dollars in damages, cost you months in lost rent, and trap you in a stressful, time-sucking eviction process. A proper background check helps you sidestep these nightmares by verifying an applicant's track record.

Here’s what a robust screening process really delivers:

- Fewer Rent Defaults: By verifying their income and credit history, you can confirm an applicant is financially stable and can actually afford the rent.

- Protection Against Property Damage: Checking references from previous landlords gives you a window into how they’ve treated their past rentals.

- A Safer Community: If you own a multi-unit property, ensuring tenants don't have a history of disruptive behaviour makes life better and safer for everyone.

- Less Tenant Turnover: Choosing the right person from the get-go usually leads to longer, more stable tenancies. That means less time and money spent finding new occupants every year.

Think of it this way: investing a little time in a proper tenant background check upfront is like buying an insurance policy against future problems. It’s about being proactive, not reactive, with your property management.

This proactive approach doesn't just protect your income; it gives you invaluable peace of mind. Knowing you've placed a responsible, vetted person in your property lets you breathe easier and focus on other things, confident that your investment is in good hands.

Navigating Australian Tenant Screening Laws

Before you even think about running a tenant screening background check, you need to get your head around Australia’s legal framework. This isn't just about ticking boxes; it's a legal minefield designed to protect you and your potential tenants from messy disputes and discrimination claims.

Getting this right from the get-go is non-negotiable.

The two big players here are the Privacy Act 1988 and the various state and territory anti-discrimination laws. The Privacy Act dictates how you handle personal information—collecting it, using it, and storing it safely. Meanwhile, the anti-discrimination rules make sure you’re assessing every applicant on a level playing field.

The absolute cornerstone of this whole process is getting explicit written consent. You simply cannot pull a credit report or peek into a tenancy database without the applicant's clear permission. This is usually a section on the rental application form where they sign off, giving you the green light. Crucially, this consent has to be informed—they need to know exactly what you’re looking at and why.

What You Can and Cannot Ask

Knowing where the line is drawn is everything. You need enough info to make a smart decision, but stepping over that line can land you in serious hot water. My advice? Stick to what's relevant to the tenancy. It keeps the process fair and, most importantly, compliant.

Here’s what you can confidently ask for:

- Proof of identity (a driver’s licence or passport works well)

- Income and employment details (recent payslips or an employment contract are standard)

- Their rental history, including references from previous landlords

- How many people will be living in the property

- Permission to check national tenancy databases like TICA or the National Tenancy Database (NTD)

And here's what you should never, ever ask about:

- Their marital status, sexual orientation, or gender identity

- Race, ethnic background, or religious beliefs

- Whether they’re pregnant or planning to start a family

- Any details about disabilities or health conditions (unless it’s directly related to a modification they’ve requested for the property)

- Bank statements that show their personal spending habits

A solid, compliant screening process zeroes in on one thing: the applicant's ability to meet their responsibilities under the lease. Anything else is not only irrelevant but could be seen as discriminatory and illegal.

For example, you can absolutely turn down an applicant if their verified income doesn't stack up against the rent. That’s a legitimate financial reason. What you can’t do is reject them because you’re making assumptions based on their cultural background.

On a related note, keeping your own finances in order is just as crucial. A big part of being a professional landlord is managing your books well—you can check out our guide on essential https://onsilent.com/non-classe/rental-property-tax-deductions/ to get organised. Being diligent on both sides of the coin, screening and finances, is what separates the pros from the amateurs.

What Goes into a Comprehensive Background Check?

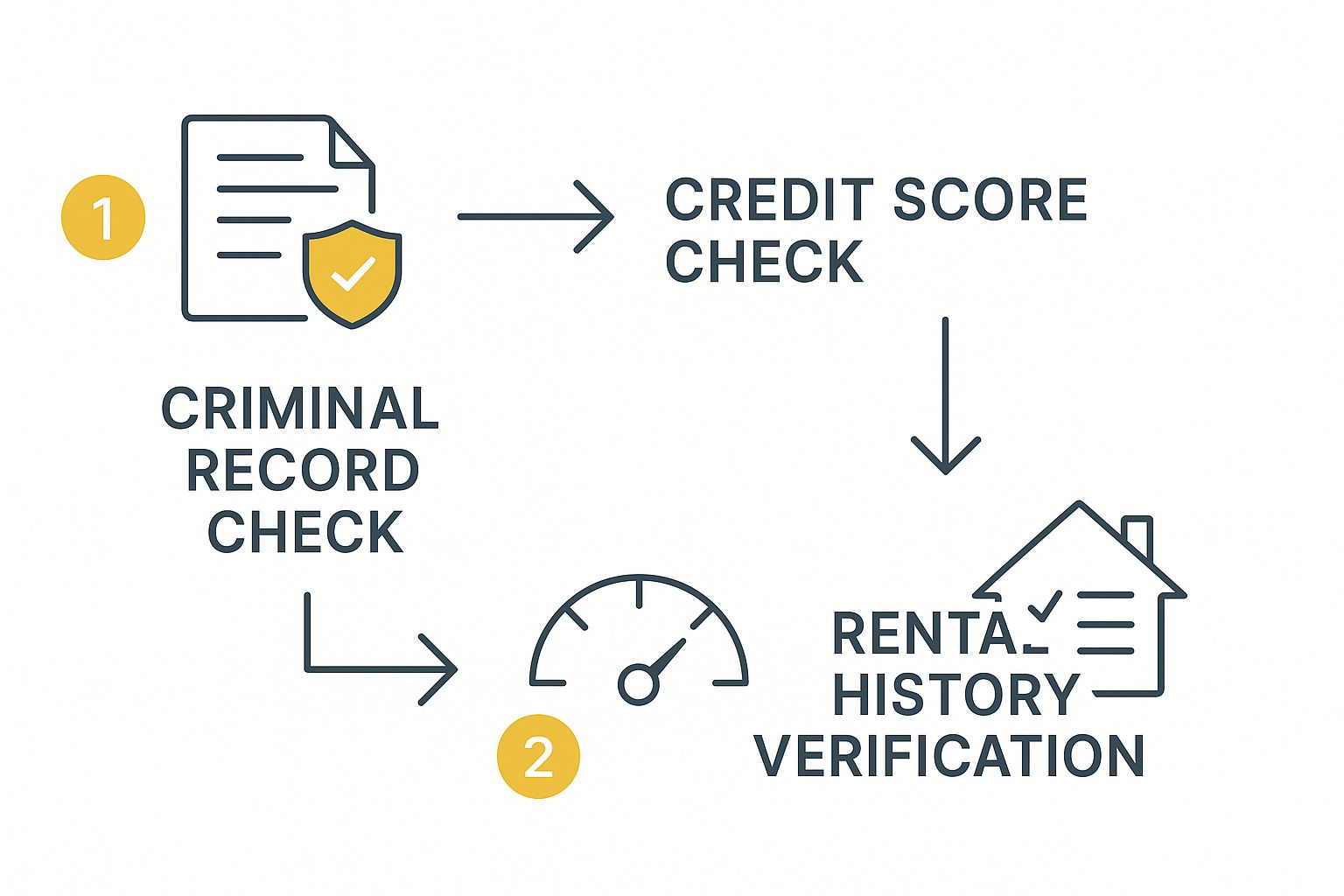

Getting a good feel for a tenant goes way beyond a simple gut feeling. A proper, compliant tenant screening background check is about piecing together a clear picture of your applicant using several key sources of information. Think of it like a puzzle—each piece tells you something different, and when you put them all together, you can make a leasing decision with real confidence.

This flow chart breaks down the core checks you'll be running.

As you can see, a solid screening process is a mix of financial due diligence and checking their track record. You can't just rely on one part; they all work together.

To get started, let's break down the essential components you should be looking at. This table summarises the critical checks, what to look for, and why each one is so vital for sizing up a potential tenant.

Essential Components of a Tenant Screening Check

| Check Component | What to Look For | Why It Matters |

|---|---|---|

| Credit Report | Patterns of late payments, defaults, accounts in collections, or a very high debt-to-income ratio. | Provides a snapshot of their financial habits and reliability in meeting payment obligations. |

| Rental History | Timely rent payments, property care, positive landlord references, and no history of lease breaches or evictions. | Past rental behaviour is one of the strongest predictors of future tenant conduct. |

| Employment & Income | Stable employment, sufficient and verifiable income (usually 3x the rent), and consistency with application details. | Confirms they have the financial means to comfortably afford the rent on an ongoing basis. |

| Tenancy Databases | Any listings for serious breaches like malicious damage, significant rental arrears, or breaking a lease. | A listing is a major red flag, indicating a serious issue with a previous tenancy. |

| Criminal Record | Relevant convictions that could pose a risk to the property or other residents (subject to legal guidelines). | Helps protect the property, neighbours, and your business from potential safety and liability issues. |

By methodically working through each of these checks, you're building a complete profile that allows for a much more informed and less risky decision.

Getting stuck into the Credit Report

An applicant's credit report is your window into their financial responsibility. It shows you how they’ve handled money and debts in the past, which is a pretty solid indicator of how they’ll handle paying rent. When you’re looking it over, focus on patterns, not just a single slip-up. A history of late payments, defaults, or accounts sent to collections are serious red flags you can't ignore.

But hold on—don't just automatically write someone off for a low credit score. Sometimes a younger applicant or a recent immigrant simply hasn't had the chance to build up a credit history. This is where you need to use your judgement and look at the whole picture.

Verifying their Rental and Employment History

This is where you get the real story from people who have dealt with them before. You absolutely must contact their previous landlords or property managers to ask the important questions:

- Did they pay their rent on time, every time?

- How did they look after the property?

- Were there any major complaints or lease breaches?

- And the big one: Would you rent to them again?

At the same time, you need to confirm their job and income. Ask for recent payslips or an employment contract to make sure they have a steady income that can comfortably cover the rent. A good rule of thumb is that their gross income should be at least three times the monthly rent.

The real goal here is to verify the information they gave you on their application. If you find gaps between what they claimed and what their references tell you, that's a massive warning sign. It’s not just about what you uncover, but whether the applicant was honest from the get-go.

Using Tenancy Databases the Right Way

Here in Australia, we have powerful tools like TICA at our disposal. These official tenancy databases list tenants who have been blacklisted by a property manager for a serious breach, like owing a huge amount of rent or causing malicious damage to a property.

Checking these databases is a non-negotiable final step. Finding your applicant on one of these lists is a serious problem that needs careful thought and a direct conversation with them.

To see how all these pieces fit together in practice, you can dive into our guide on how to screen tenants effectively. It will give you the practical steps to build a screening system you can use time and time again.

The need for these detailed checks is only growing. The Australian tenant screening market was valued at around USD 1.95 billion in 2024 and is projected to hit over USD 3.66 billion by 2032. You can check out more on these tenant screening market trends to see why this level of due diligence is no longer optional—it's standard practice. By reviewing each of these areas, you swap guesswork for a decision backed by solid data.

How to Choose the Right Tenant Screening Service

With a flood of options out there, picking the right service to handle your tenant screening background check can feel overwhelming. Do you go for a comprehensive, all-in-one platform or try to piece things together yourself?

The best choice really boils down to your specific needs, your budget, and how much time you’re willing to invest. Let's break it down.

A full-service screening company offers pure convenience. They bundle everything from credit reports to tenancy database checks into a single, user-friendly package. This approach is fantastic for busy landlords who prioritise efficiency and want a streamlined, compliant process without having to juggle multiple data providers. It simplifies decision-making and often comes with built-in compliance features, which is a huge plus.

On the other hand, a do-it-yourself (DIY) approach can be more cost-effective, especially if you only need specific checks for each applicant. This method, however, demands more of your time and a solid understanding of the legal maze to avoid accidentally breaching privacy or anti-discrimination laws. Honestly, for most landlords, the time saved and peace of mind offered by a reputable service is well worth the cost.

Your Evaluation Checklist for Screening Services

When you start comparing providers, don't just look at the price tag. The quality and depth of the data are what truly matter. A cheap but unreliable report is worse than no report at all—it gives you a false sense of security.

Use this checklist to assess any service you're considering:

- Comprehensiveness of Checks: Does the service access official tenancy databases like TICA and the National Tenancy Database (NTD)? Does it provide a full credit report from a major bureau like Equifax or Illion? These are non-negotiable.

- Report Turnaround Time: How quickly can you get a completed report? In a competitive rental market, waiting days for results could mean losing a great applicant to another landlord. Speed matters.

- Regulatory Compliance: The service absolutely must operate in full compliance with Australian privacy and tenancy laws. Make sure they require proper applicant consent and handle personal data securely.

- User Experience (UX): Is the platform actually easy to navigate? A clunky, confusing interface will only add to your workload and create headaches you don't need.

My biggest piece of advice is to look for transparency. A quality service will be upfront about where their data comes from and what each check includes. If a provider is vague about their sources or their reports seem thin on detail, that's a massive red flag.

Ultimately, your goal here is to find a partner that delivers accurate, actionable insights. A robust tenant screening background check empowers you to make a confident leasing decision, protecting your investment for the long term. Choose a service that helps you achieve that with clarity and reliability.

Alright, you’ve got the completed tenant screening background check report in your hands. Getting the report is just the start—the real work begins now. The true skill is in looking at that data and making a smart, fair, and legally solid leasing decision. It's about piecing together the story behind the numbers.

You’re not hunting for a perfect tenant, because let’s be honest, they’re incredibly rare. Instead, you're assessing risk by understanding the context. A single late payment from three years ago tells a very different story than a recent string of defaults and accounts sent to collections.

Your task is to connect the dots. Does their declared income actually stack up against what the credit report suggests? Do the tenancy dates they provided line up with what their previous landlord told you? Answering these questions helps you build a picture you can trust.

Weighing the Findings Consistently

To keep things fair and, more importantly, compliant, you need to apply the exact same criteria to every single application. No exceptions. This means figuring out your non-negotiables before you even glance at the first report. This consistent framework is your best shield against any accusations of discrimination.

So, what might these pre-set criteria look like? Here are a few common examples:

- A minimum gross income that is three times the monthly rent.

- A clean slate—no history of evictions or listings on a tenancy database like TICA.

- Good, solid references from their last two landlords.

- No outstanding debts to utility companies or former property managers.

Having this clear, objective standard means your decisions are based on business rules, not gut feelings. If someone doesn't meet a key benchmark, the decision is already made for you.

The aim here is to create a decision-making process that’s both repeatable and fair. When you assess every applicant's tenant screening background check against the same strict criteria, you protect yourself and ensure you’re operating ethically.

This structured approach isn't just about compliance; it's about being professional and efficient. For property managers wanting to sharpen their processes even more, you might find our insights on improving property management efficiency useful.

Handling Negative Information and Discrepancies

So, what do you do when something negative pops up? A low credit score, an unexplained gap in their rental history, or a reference that wasn’t exactly glowing doesn't have to be an instant "no". In Australia, the principles of fairness mean you should give the applicant a chance to explain themselves.

Never make a final call based on a red flag without talking to them first. A straightforward, professional chat can often clear things up. There could be a perfectly reasonable explanation for a credit issue, like a recent divorce, a medical emergency, or a messy dispute with a telco.

By starting a conversation, you're not just getting more information; you're also showing that you run a fair process. For instance, if their income is a little on the low side but they’ve got substantial savings and a flawless rental history, that context could make them a fantastic candidate. This balanced perspective is key to securing the best tenants.

Ultimately, thorough screening gives landlords the confidence to set appropriate rental prices, a trend supported by data from the Australian Bureau of Statistics. You can dive into the details of these rental market insights on the ABS website. Taking that extra time to properly interpret a tenant screening background check is a fundamental part of a confident and successful leasing strategy.

Got Questions About Tenant Background Checks?

Even with a rock-solid process, you're bound to run into questions when you're screening tenants. Getting straight answers is the key to moving forward confidently and, most importantly, keeping everything above board. Let's tackle some of the most common questions we hear from Aussie landlords.

This isn't about dry legal jargon; it's about giving you the real-world clarity you need to make smart, fair decisions on the ground.

How Long Does a Tenant Background Check Usually Take in Australia?

The honest answer? It varies. The turnaround time really hinges on how deep you’re digging and the screening service you decide to use.

Simple checks, like confirming someone's identity or running their name through tenancy databases like TICA, are usually lightning-fast. You can often get these results back in just a few hours. In a competitive rental market, that speed can be a massive advantage, stopping you from losing a great applicant to another property.

On the other hand, a more thorough check—one that involves actually picking up the phone to call previous landlords and verify employment—will naturally take a bit longer. For this kind of deep dive, it's pretty standard to allow anywhere from 24 to 72 hours for the complete picture. The trick is to find a service that gives you both speed and accuracy.

Can I Reject a Tenant Based on Their Credit Report?

Yes, you can, but you have to be careful about how you do it. A poor credit history is a perfectly legitimate business reason to decline an application. If their report shows a history of defaulting on rent, utilities, or other major debts, that's a direct reflection of their ability to pay you on time.

The crucial thing here is consistency. You absolutely must apply the same financial standards to every single person who applies.

You can't knock back one applicant for a low credit score and then accept another with a similar or even worse one. Figure out your minimum financial criteria before you start, write it down, and apply it to everyone, no exceptions. That documented, consistent process is your best friend if your decision is ever questioned.

What Should I Do If an Applicant Has No Rental History?

Don't panic—this is an incredibly common scenario. You’ll see this all the time with first-time renters like uni students, young professionals just starting their careers, or people who have recently moved to Australia. A lack of rental history isn't a red flag by itself.

It just means you need to shift your focus to other indicators of reliability. Look for these instead:

- Solid Income Verification: Can they comfortably cover the rent? Ask for an employment contract or a few recent payslips to see that they have a stable and sufficient income.

- Stable Employment History: A good track record at their job, even without rental history, shows they're reliable and can hold a commitment.

- A Guarantor or Co-Signer: You can always ask for a guarantor (often a parent) who meets the financial requirements and is willing to go through a background check themselves. This adds a great layer of financial security for you.

By zeroing in on these other areas, you can confidently assess an applicant who’s new to the rental game.

Is It Legal to Charge Tenants for a Background Check?

This is a big one, and the answer is a classic: it depends entirely on your state or territory’s specific tenancy laws. The rules are not the same across Australia, and getting this wrong can land you in hot water.

For example, in places like New South Wales, landlords are generally banned from charging tenants for the cost of processing an application. In other states, you might be able to charge a reasonable fee that covers the direct cost of the screening itself.

Before you even think about passing this cost on, you must check your local residential tenancy act. This isn't optional. Breaking these rules, even by accident, can lead to fines and disputes. Always, always verify what’s allowed in your specific location first.

A great screening process is the cornerstone of smart property management. To streamline your communications and make sure you never miss an important call from a potential tenant or contractor, check out OnSilent. Our smart call management solution filters out spam and organises your messages, saving you hours every week. See how OnSilent can help you.