So, you’ve taken the leap and bought a rental property. That’s a massive financial move, but what many investors don't quite grasp is just how much they can save come tax time.

Put simply, rental property tax deductions are just legitimate expenses you can claim against your rental income. Claiming them lowers your taxable income, which means more money stays in your pocket instead of going to the tax man. Getting this right is one of the most powerful tools you have for boosting your return on investment.

Unlocking Your Investment's Full Tax Potential

Start thinking of your rental property less like a simple building and more like a small business. And just like any business, it has running costs. The good news is the Australian tax system lets you claim most of these costs against the income your property brings in. This simple idea is the bedrock of building wealth through property. When you systematically track and claim every single eligible expense, you slash your overall tax bill and seriously improve your annual cash flow.

But here’s the catch: you have to be precise. The Australian Taxation Office (ATO) has been paying very close attention to landlord tax returns lately, and what they’ve found is a bit of a shock. A recent ATO crackdown revealed that a staggering 9 out of 10 rental property owners were making mistakes on their returns. We're talking everything from overclaiming repairs to getting the loan interest apportionment wrong. It’s a huge compliance gap, and it’s prompting the ATO to be much stricter.

Why Getting Your Head Around Deductions Is a Game-Changer

Understanding tax deductions isn't just about saving a few dollars here and there; it’s about making your investment perform at its absolute best. For most landlords, the loan interest is the biggest single deduction, but there are dozens of smaller, ongoing costs that really add up.

Many of these are immediately claimable in the same financial year you pay for them. These are your bread-and-butter expenses, such as:

- Property management and letting fees

- Costs to advertise for new tenants

- Council and water rates

- Land tax and body corporate fees

- Premiums for building, contents, and landlord insurance

The key is to shift your mindset. Stop seeing these as just annoying costs. Instead, view them as strategic opportunities to shrink your taxable income. Every dollar you can legitimately claim is a dollar that stays with you, not the tax office.

To give you a quick snapshot, here are some of the most common deductions you should have on your radar.

Quick Guide to Common Rental Property Tax Deductions

| Deduction Category | What It Covers | Key Consideration |

|---|---|---|

| Loan Interest | The interest portion of your mortgage repayments on the loan used to buy the property. | You can only claim the portion of the loan used for the rental property. |

| Repairs & Maintenance | Work to fix wear and tear or restore something to its original condition (e.g., fixing a broken window). | Must be a genuine repair, not an improvement that enhances the property's value (which is a capital works deduction). |

| Property Management Fees | All fees paid to a real estate agent for managing the property, collecting rent, and finding tenants. | Fully deductible in the year you incur the expense. |

| Council & Water Rates | The rates you pay to your local council and water authority. | If the tenant pays for their water usage, you can't claim that amount. |

| Insurance Premiums | Premiums for landlord, building, and contents insurance policies. | Protects your investment and is a straightforward deduction. |

| Depreciation | The decline in value of the building's structure (capital works) and the assets within it (plant & equipment). | This is a "non-cash" deduction. You'll need a quantity surveyor's report to claim it correctly. |

This table is just the beginning, but it covers the big ticket items most landlords can claim.

Beyond these immediate write-offs, you have "non-cash" deductions like depreciation. This is where you claim the wear and tear on the building itself and assets like ovens or carpets over many years. It's a fantastic deduction because it can significantly improve your financial position without you having to spend a cent in that particular year.

Don’t worry, we’ll walk you through each of these categories, making sure you can confidently and correctly claim everything you're entitled to.

Claiming Your Immediate Property Expenses

Think of your rental property like any other business. Just like a cafe has to pay for coffee beans and staff, your property has day-to-day running costs. These are the ongoing expenses you pay throughout the year to keep the place tenanted and in good shape.

The good news is, you can often claim these costs as immediate deductions against your rental income. Unlike bigger capital costs that you claim over many years, these expenses give you a tax benefit in the same financial year you pay them. Getting your head around this is a game-changer for your annual cash flow and helps make sure you're not handing over more tax than you need to.

Let's break down the key costs you can claim right away.

Management and Tenant Costs

If you’ve got a real estate agent managing your property, their fees are one of the most common and clear-cut deductions you can make. It's a direct cost of earning your rental income, so it's fully claimable.

But it’s not just their monthly commission. You can also claim a bunch of other related charges:

- Letting Fees: That one-off fee for finding and placing a great new tenant.

- Advertising Costs: Any money you spent marketing the property to attract renters.

- Administration Fees: Other bits and pieces your agent might charge for, like preparing lease documents.

Basically, if your property manager charges you for a service, it’s usually deductible. Just hang onto all their statements – they’re the perfect record of these expenses for tax time.

Navigating Rates and Statutory Charges

As a property owner, you’ll be familiar with the regular bills from the government and, if you're in a complex, the body corporate. These are non-negotiable costs of owning property, and thankfully, they're deductible when the property is earning you an income.

You can typically claim the full amount for these charges:

- Council Rates: The quarterly or annual bills from your local council.

- Water Rates: This covers the fixed service charges from the water authority. Just a heads-up: you can't claim the cost of the tenant's water usage if they pay you back for it.

- Land Tax: A big one for many investors. This annual tax on the value of the land you own is a significant deduction.

- Body Corporate Fees: If your property is an apartment or townhouse (strata title), these regular fees for maintaining common areas are also on the list.

The Power of Claiming Loan Interest

For most property investors, this is the big kahuna of tax deductions. The interest you pay on your investment loan often represents your largest single expense, and the great news is that it’s entirely deductible.

It’s absolutely vital to remember you can only claim the interest portion of your loan repayments, not the principal part that actually pays down your loan balance. Your lender will send you an annual statement that spells out exactly how much interest you've paid over the financial year. This document is your golden ticket for the ATO.

Be careful if your loan has been split or refinanced to cover both personal and investment uses (like buying a car and the rental property on the same loan). You can only claim the portion of interest that directly relates to the investment property, so you'll need to apportion it accurately.

The Australian tax system lets landlords claim a wide range of expenses, from agent fees to repairs. But it’s crucial to know the difference between an immediately deductible repair (fixing something that’s broken) and a capital improvement (adding something new), which has to be depreciated over time. You can learn more about navigating these rules from the experts at Reckon.com.

Insurance and Other Essential Protections

Protecting your asset isn’t just smart; it’s a deductible business expense. The premiums you pay for insurance policies on your rental property are fully claimable in the year you pay them.

This covers a few different types of policies:

- Building Insurance: Protects the actual structure of your property from things like fire or storm damage.

- Landlord Insurance: A specific policy that’s worth its weight in gold, covering risks like a tenant defaulting on rent or causing malicious damage.

- Contents Insurance: Covers any items you own inside the property that the tenant uses, like blinds, carpets, or appliances.

- Public Liability Insurance: Protects you if a tenant or visitor gets injured on your property and you're found liable.

Distinguishing Repairs From Improvements

One of the trickiest parts of being a property investor is getting your head around the difference between a repair and an improvement. It’s a common tripwire, and getting it wrong can unfortunately put you on the Australian Taxation Office (ATO)'s radar.

It's an easy mistake to make, but understanding this distinction is crucial for smart tax planning. It determines whether you can claim an expense right away or if you have to stretch it out over several years.

Think of it this way: a repair is all about getting something back to its original working condition. You're just fixing everyday wear and tear. If a storm cracks a window and you call someone to replace the glass, that's a classic repair. You’ve simply returned the window to how it was before it got damaged.

Maintenance is a close cousin to repairs. It’s the work you do to prevent problems down the track or just keep things ticking along nicely. Getting the air-con serviced every year or slapping a fresh coat of paint on a faded wall are perfect examples. Both repairs and maintenance are usually 100% deductible in the same financial year you foot the bill.

What Makes an Improvement Different

A capital improvement, on the other hand, is a different beast altogether. It goes beyond a simple fix and actually enhances the property, making it better than it was before. This could mean boosting its value, changing its function, or extending its lifespan. This is where a lot of investors get caught out.

You can't claim these costs immediately. Instead, they become part of your property’s cost base, and you claim them bit by bit over many years through depreciation or as capital works deductions.

Let's break it down with a few real-world scenarios to make it crystal clear:

- Repair Example: Your tenant calls to say the kitchen tap is dripping. You get a plumber in to replace a washer and stop the leak. The tap is now back in working order. That’s a repair, and the plumber’s invoice is an immediate, full deduction.

- Improvement Example: You decide that old, leaky tap looks a bit tired. You rip it out and install a fancy new mixer tap with a pull-out veggie sprayer. This is an improvement. You’ve upgraded the kitchen’s features and value, going well beyond its original state.

The key question you should always ask yourself is: "Did this job just fix something that was broken, or did it upgrade, enhance, or add something completely new?" The answer is everything when it comes to managing your rental tax deductions properly.

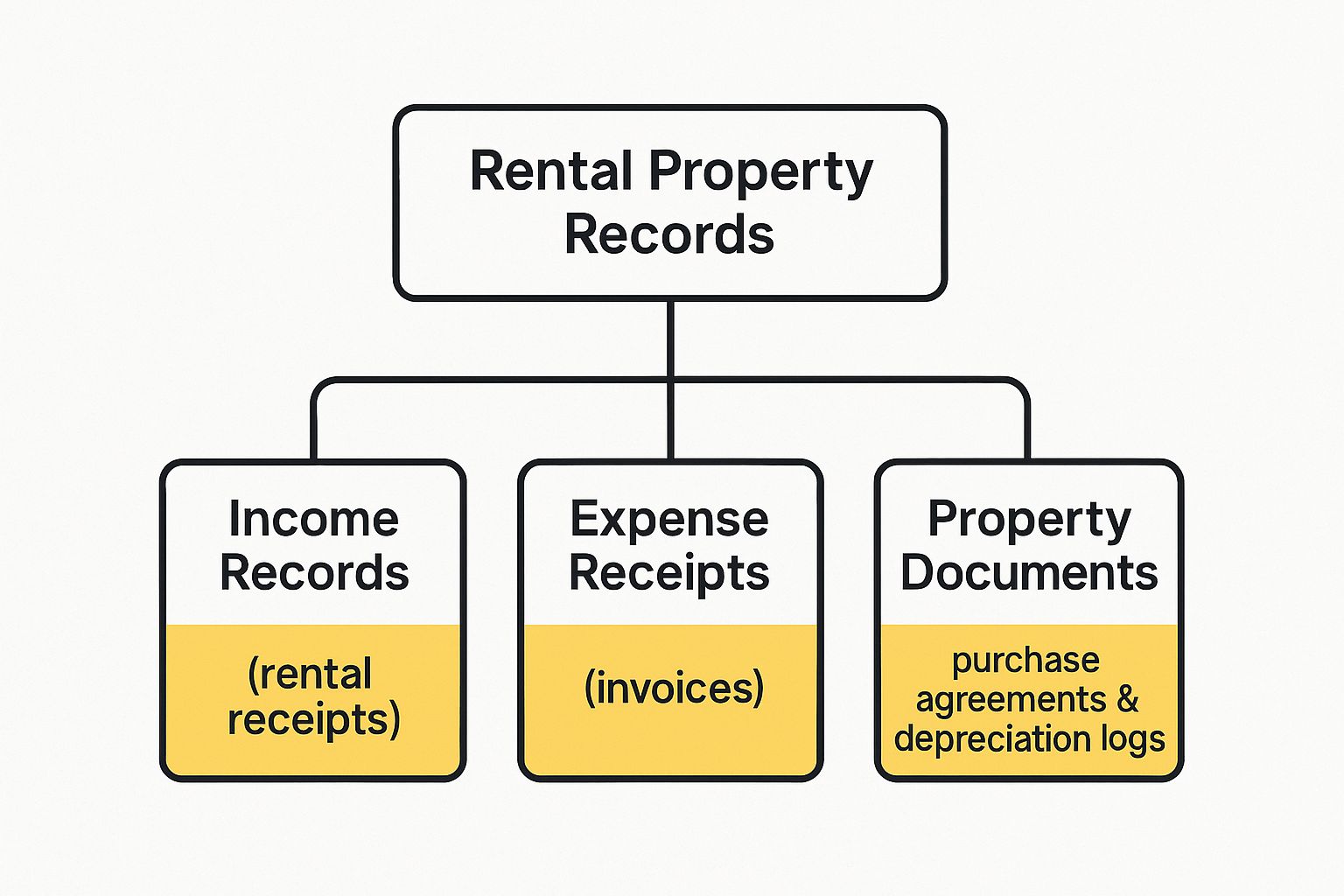

This infographic lays out the essential documents you need to have sorted to back up your claims, whether they're for immediate write-offs or capital works.

As you can see, invoices for both repairs and improvements are vital records. You need to file them carefully along with your other income and property documents.

Side-By-Side Comparison

I get it – sometimes the line between the two can feel a bit blurry, especially when one job seems to have elements of both. This table should help clear things up.

| Scenario | Repair (Immediate Deduction) | Improvement (Capital Works/Depreciation) |

|---|---|---|

| Flooring | Replacing a handful of cracked tiles in the bathroom. | Tearing up the old tiles to pour and polish a brand new concrete floor. |

| Fencing | Replacing a few broken palings on an old timber fence. | Demolishing the timber fence and building a new brick one in its place. |

| Appliances | Getting a technician to fix a broken heating element in the oven. | Swapping out a basic but working oven for a modern smart oven with new features. |

| Roofing | Replacing roof tiles that were smashed in a hailstorm. | Extending the existing roofline to build a new covered patio. |

There’s one more tricky spot to watch out for: what the ATO calls "initial repairs." If you buy a property and straight away have to fix a heap of issues that were there when you bought it—think a saggy fence or a kitchen that’s seen better days—those aren't treated as normal repairs.

Because the problems existed at the time of purchase, the cost to fix them is considered a capital expense. It gets added to your property's cost base rather than being claimed as an immediate deduction.

Unlocking Depreciation and Capital Works Deductions

While claiming for immediate expenses is pretty straightforward, one of the most powerful rental property tax deductions doesn't actually involve you spending any money in that financial year. I'm talking about depreciation—a 'non-cash' deduction that so many investors either miss completely or don't claim properly, leaving a serious amount of cash on the table.

Think of depreciation as a way to claim for the natural wear and tear on your property and the assets inside it. The Australian Taxation Office (ATO) gets that buildings and the things in them don't last forever. They have a limited effective life, and the good news is, they let you claim that loss in value as a tax deduction each year.

This game-changing tool is broken down into two main categories. Getting your head around both is absolutely crucial if you want to maximise your returns.

Claiming for Plant and Equipment

First up, we have Depreciating Assets, which you'll often hear called Plant and Equipment. These are basically all the individual items in your property that aren't permanently fixed to the building's structure. You get to claim a deduction for the decline in their value.

A good way to think about it is to imagine turning the house upside down—anything that would fall out is likely a depreciating asset. Some of the most common examples include:

- Carpets and vinyl flooring

- Blinds and curtains

- Ovens, cooktops, and rangehoods

- Dishwashers and air conditioning units

- Hot water systems and ceiling fans

The ATO gives each of these items an 'effective life,' which dictates how many years you can claim its depreciation for. A new carpet, for instance, might be depreciated over 10 years, whereas a dishwasher might have a shorter lifespan.

Understanding Capital Works Deductions

The second, and usually much bigger, category is Capital Works. This is the deduction you can claim for the construction cost of the building itself, plus any major structural improvements you make along the way. It covers the wear and tear on the bones of the property—the foundations, walls, roof, and other fixed parts.

Generally, you can claim a capital works deduction for residential properties built after 17 July 1985. The claim is typically calculated at 2.5% of the original construction cost each year, for up to 40 years. This doesn't just apply to the initial build; it also covers any big structural jobs later on, like adding a new deck or renovating a bathroom.

This deduction for the building's structure is a huge advantage for investors. It directly reduces your taxable income, boosting your cash flow without requiring you to spend a cent in that year. It's a paper deduction that delivers real-world savings.

The Secret Weapon: A Quantity Surveyor's Report

So, how on earth do you work all this out, especially the original construction cost of a building you didn't build yourself? The answer is simple: a Tax Depreciation Schedule prepared by a specialist quantity surveyor.

This report is your ultimate roadmap for all depreciation-related rental property tax deductions. A qualified quantity surveyor will visit your property, inspect it from top to bottom, and create a detailed schedule. This document will list every single eligible depreciating asset and the construction costs for capital works, giving you a year-by-year breakdown of every deduction you're entitled to claim. It ensures you're playing by the ATO's rules while squeezing every last dollar out of your investment.

Honestly, getting a one-off depreciation schedule is one of the smartest things a property investor can do. The tax savings you'll get from a quality report almost always outweigh its cost in the first year alone, and it will keep paying for itself for decades. It really is the key to unlocking these powerful, but often misunderstood, tax deductions.

Rules for Personal Use and Short-Term Rentals

The game has definitely changed for holiday homes and investment properties that aren't rented out all year round. With the explosion of short-term rental platforms, the Australian Taxation Office (ATO) is taking a much closer look at how landlords are declaring their income and expenses. If you use your property for your own getaways or it sits empty between guests, you can't just claim 100% of the expenses.

This is where a crucial concept called apportionment comes into play. Think of it like slicing up a pizza. If your property was only genuinely available for rent for half the year, you can only claim half of the expense "pizza." You have to split your costs fairly between the time the property was actually up for rent and the time it was used privately or was otherwise off the market.

Nailing this calculation is fundamental. It’s one of the most important parts of lodging a correct tax return and getting your rental property tax deductions right.

How to Correctly Apportion Your Expenses

The key to your calculation is the number of days the property was genuinely available for rent at a fair market rate. This doesn't count the days you blocked out for your family holiday, periods you let mates stay for free, or any extended time it was unlisted while you were doing renovations.

Let’s walk through a simple, real-world example.

Imagine you own a beach house. In the last financial year:

- It was rented to paying guests for 120 days.

- It was vacant but genuinely advertised and available for rent for 65 days.

- You and your family used it for personal holidays for 30 days.

- Your total claimable expenses for the year (like rates, insurance, and interest) came to $20,000.

First, you need to work out the total number of days it was actually available for rent: 120 days (rented) + 65 days (available) = 185 days. So, the property was available for rent for just over half the year (185 / 365 days = ~50.7%).

This means you can only claim 50.7% of your total expenses: $20,000 x 0.507 = $10,140. The other $9,860 is tied to your private use and can't be claimed as a deduction.

Renting to Family and Friends Below Market Rate

Here’s another common situation that gets the ATO’s attention: renting to family or friends at "mates rates." While it’s a nice thing to do, it comes with specific tax rules. If you're charging rent that's well below the going market rate, your deductions are usually limited to the amount of rental income you actually receive for that time.

Simply put, you can't create an artificial loss by charging your cousin next to nothing while trying to claim all the expenses. For instance, if the market rent is $500 a week but you charge your cousin $150, your deductions for that week are capped at $150. Getting these details right is crucial, as is having a solid system to improve your overall property management efficiency.

Short-term rental properties have gained particular attention in the Australian tax landscape, especially with the rise of platforms like Airbnb. Landlords who rent their properties for only part of the year while using them personally for the rest must apportion their expenses accordingly. New rules like the Victorian Short-Stay Levy also require landlords to adjust their tax and record-keeping practices. Discover more insights about property tax returns for holiday rentals on MadeComfy's blog.

Creating an Audit-Proof Record-Keeping System

Let's be blunt: your records are your single best line of defence against an Australian Taxation Office (ATO) audit. They're also the bedrock for claiming every single deduction you're legally entitled to. It's best not to see record-keeping as a chore, but as a strategic asset that buys you complete peace of mind.

Without solid proof, even a perfectly legitimate expense can be knocked back, costing you hundreds or even thousands of dollars. The ATO is crystal clear on this: you must keep your records for at least five years from the date you lodge your tax return. That's not a friendly suggestion; it’s a hard-and-fast rule.

What Documents You Absolutely Must Keep

Building an audit-proof file starts with knowing exactly what to hang onto. Your goal is to create a complete financial story for your investment property, from the day you bought it until the day you eventually sell it. This means going well beyond a shoebox stuffed with receipts.

Here’s a checklist of the essentials:

- Proof of Income: Keep copies of every tenant lease agreement, your property manager’s statements, and bank statements that show the rental deposits hitting your account.

- Expense Evidence: Hold onto every single invoice and receipt for the expenses you claim. We're talking everything from council rates and insurance policies to the plumber's bill and pest control invoices.

- Loan Documents: Your loan statements are crucial, especially the annual summary that shows the total interest you've paid. This is usually one of your biggest deductions.

- Purchase and Sale Records: The original contract of sale, plus records for stamp duty and conveyancing fees, are non-negotiable. You'll need these to calculate your property’s cost base.

- Depreciation and Capital Works: A quantity surveyor's depreciation schedule is a must-have document. The same goes for any receipts for capital improvements you make over the years.

Organising Your Records for Simplicity

Once you know what to keep, you need a system to keep it organised. Let’s be honest, a messy folder is almost as bad as having no records at all. The best system is simply the one you'll actually use consistently.

Transforming your record-keeping from a dreaded task into a strategic habit is key. A well-organised system not only simplifies your tax obligations but also provides a clear, real-time view of your investment's performance, which is vital for making smart financial decisions.

For many investors, a simple digital approach works wonders. Create a main folder for your rental property on your computer or a cloud drive, then make sub-folders for each financial year. Inside each year, create more specific folders like "Income," "Expenses," "Loan," and "Legal."

Whenever a digital receipt or statement lands in your inbox, file it away immediately. For paper receipts, use a scanning app on your phone to digitise them on the spot. This kind of discipline builds powerful habits. In fact, our guide on time management for real estate agents touches on similar principles you could apply here.

Alternatively, dedicated accounting software or even a well-structured spreadsheet can be a game-changer. These tools don't just store your information; they can help categorise expenses and track your financial position all year round, making tax time far less of a headache.

Got Questions About Rental Property Deductions? We've Got Answers

Even when you feel like you've got a handle on the basics, the world of rental property tax deductions can still throw you a curveball. It’s a space filled with tricky nuances, and it’s completely normal to have questions about those "what if" scenarios.

Getting to grips with these grey areas is a smart move. It not only builds your confidence as a landlord but also keeps you on the right side of the Australian Taxation Office (ATO). Let’s dive into some of the most common questions we hear from property investors just like you.

Can I Claim Travel Costs for Inspecting My Rental Property?

In most cases, the answer is a firm no. The ATO put a stop to this back on 1 July 2017, disallowing deductions for travel expenses related to inspecting, maintaining, or collecting rent for residential rental properties.

This rule covers things like airfares, your car expenses (think fuel and general wear and tear), and any accommodation you might need. There are a few very rare exceptions, like for investors who are officially "carrying on a property rental business," but for the vast majority of individual landlords, travel costs are off the table.

What If I Pre-Pay an Expense Like Insurance?

Good question! If you prepay a rental expense, like your annual insurance premium, you might be able to claim an immediate deduction for the full amount. It really just depends on the cost and the timeframe it covers.

Here's the deal: if the prepaid expense is under $1,000 or covers a period of 12 months or less that wraps up in the same financial year, you can usually claim it all in the year you paid. For anything bigger or covering a longer period, you'll need to spread the deduction out over the life of the service.

Key Insight: Playing it smart with prepayments can be a great little cash flow strategy. It lets you bring deductions into the current financial year, which can be a real help depending on your tax situation.

Is the Cost of Getting Tax Advice Deductible?

You bet it is. Any money you spend on managing your tax affairs is deductible. This is a fantastic deduction because it helps you stay compliant while making sure you’re claiming every dollar you’re entitled to.

This includes:

- Your Accountant's Fees: The bill you pay your registered tax agent to get your tax return sorted, including the rental property schedule.

- Specific Tax Advice: The cost of getting professional advice about your investment property at any point during the year.

- Related Costs: This can even stretch to cover the cost of travelling to see your tax agent.

Can I Claim the Repairs I Did Before the First Tenant Moved In?

This is a classic trap for new investors, and the answer, unfortunately, is no. These are what the ATO calls ‘initial repairs’, and they're treated as capital expenses.

Any work you do to fix up defects, damage, or general wear and tear that was already there when you bought the place isn't immediately deductible. It doesn't matter if you did the work to make the property liveable for a tenant. Instead of an instant write-off, these costs get added to your property’s cost base, which will lower your capital gains tax bill when you eventually sell. It's a completely different kettle of fish to the ongoing repairs you do while the property is actively rented out. Of course, a crucial part of all this is finding great tenants in the first place, which is why it's so important to know how to screen tenants properly.

Managing rental properties comes with endless questions and even more phone calls. OnSilent helps busy property professionals filter out the noise and focus on what truly matters. Our smart voicemail app organises your messages, blocks spam, and ensures you never miss a critical call from a tenant or contractor, saving you hours every week. Take control of your communications with OnSilent today.