So, you’re thinking about selling your place and want to get a handle on the costs. A real estate commission calculator is your new best friend. In simple terms, it's a handy tool that gives you a ballpark figure of what you'll pay your agent before you even sign on the dotted line. You just plug in your estimated sale price and the agent's rate, and it spits out the numbers, GST and all. It’s a great way to get a clear financial picture from the get-go.

Getting Your Head Around Real Estate Commissions in Australia

Before you start crunching numbers with a calculator, it’s good to know what you’re actually paying for. An agent’s commission isn’t just some random fee—it’s their paycheque for a whole suite of services aimed at getting you the best possible price for your home. We're talking about marketing your property, running open homes, fielding calls, negotiating with buyers, and steering the whole complex sale process to the finish line.

The commission rate itself isn't a fixed number across the board. It can swing pretty wildly depending on where you are in Australia and a few other key things every seller should know about.

What Actually Drives Commission Rates?

- Property Location: An agent selling a unit in a hot metro market like Sydney or Melbourne will likely have a lower commission rate than one selling a house in a quiet regional town. Why? More agents are fighting for your business, which drives prices down.

- Property Value: It might seem counterintuitive, but higher-value properties often attract a lower percentage rate. An agent might happily take 1.8% on a $2 million home because the final payout is still massive, whereas they might need 2.5% on a $600,000 property to make it worth their while.

- Agent Experience and Agency Type: A top-gun agent with a string of record sales or a boutique agency offering the red-carpet treatment will probably charge more than a fresh-faced agent or a budget-focused brokerage. You often get what you pay for.

Understanding these moving parts is key. It’s why just asking, "what's the average rate?" can be a bit of a trap if you don't factor in your own situation.

Key Takeaway: The commission you pay is directly tied to your local market conditions and your property's value. Never assume a flat national average applies to your sale; always research rates specific to your suburb and state.

This is exactly why a real estate commission calculator is such a game-changer. It lets you play with different scenarios using rates that are actually relevant to your area.

For example, real estate commissions in Australia can range from as low as 1.6% to over 3.5%. Looking at 2025 data, New South Wales has an average floating around 2.3%, but that figure changes dramatically once you leave the city. In Sydney’s cut-throat market, the average is closer to 1.84%, but head out to a regional hub like Broken Hill, and you could be looking at 3.23%. On a $1 million property, that's a difference of nearly $14,000.

It's a similar story down in Victoria, where the state average is 2.2%. Yet, Melbourne's rate is 2.43%, while Geelong is a more affordable 1.56%. Tasmania, on the other hand, often has some of the highest rates in the country, averaging 2.8%. For a deeper dive into these numbers, you can explore the latest commission data on IREC. This just goes to show why punching an accurate, local rate into a calculator is non-negotiable for smart budgeting.

Average Real Estate Commission Rates Across Australia

Here’s a quick reference guide to give you an idea of the average commission percentages sellers can expect in each Australian state and territory.

| State/Territory | Average Commission Rate Range | Example Commission on a $800,000 Property |

|---|---|---|

| NSW | 1.8% – 2.5% | $14,400 – $20,000 |

| VIC | 1.6% – 2.5% | $12,800 – $20,000 |

| QLD | 2.5% – 3.0% | $20,000 – $24,000 |

| WA | 2.0% – 3.0% | $16,000 – $24,000 |

| SA | 2.0% – 3.0% | $16,000 – $24,000 |

| TAS | 2.5% – 3.5% | $20,000 – $28,000 |

| ACT | 2.0% – 2.5% | $16,000 – $20,000 |

| NT | 2.5% – 3.0% | $20,000 – $24,000 |

Keep in mind these are just averages. Your actual rate will depend on the factors we've discussed, so treat this as a starting point for your research and negotiations.

How To Accurately Calculate Agent Commissions

Alright, let's move past the averages and get into the nitty-gritty of how agent commissions are actually calculated. Getting your head around the different models is the key to using any real estate commission calculator properly and knowing what your final costs will look like. The two most common structures you'll come across are the flat percentage and the tiered model.

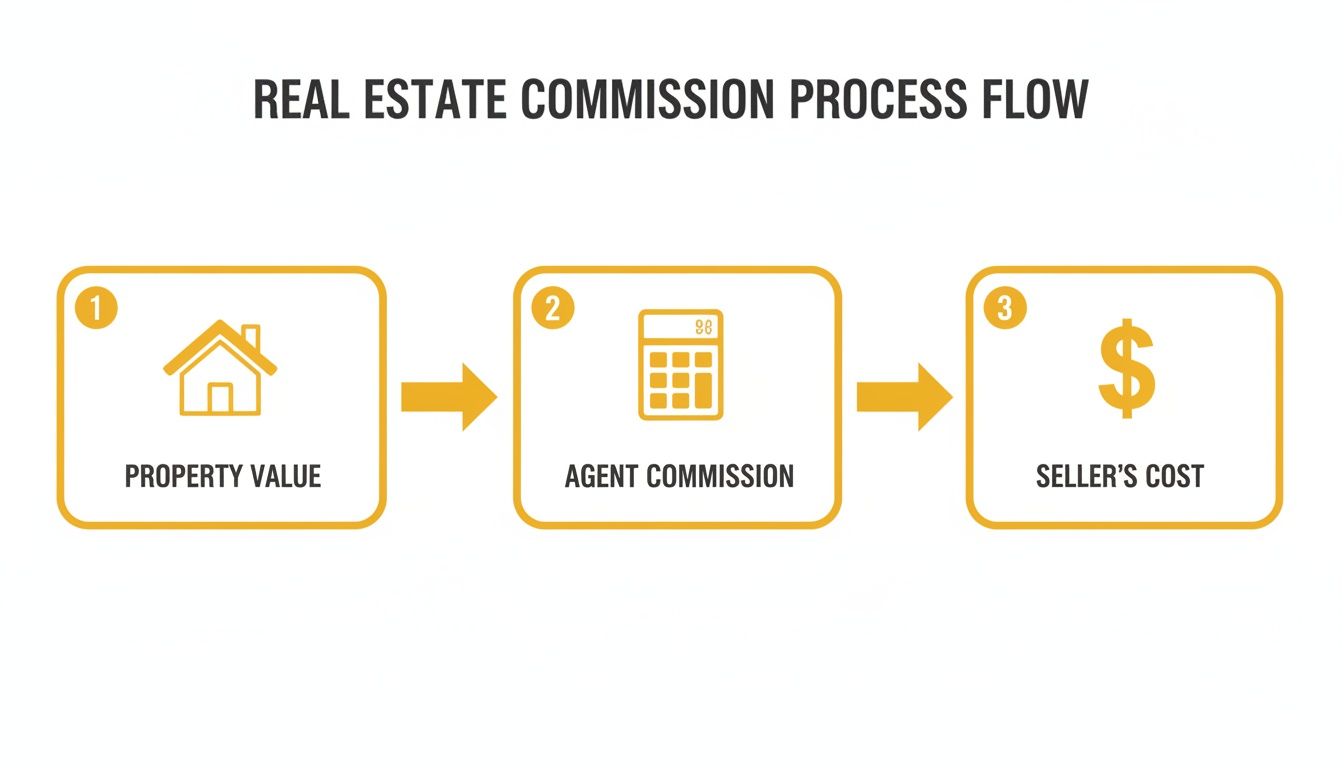

This little flowchart breaks down how the property's sale price turns into the final cost for you, the seller, after the agent's cut is taken out.

It’s a simple visual, but it makes a crucial point: the agent's fee is a direct slice of your property's final sale price.

The Standard Flat Percentage Model

The most straightforward way to structure a commission is with a flat percentage. It's exactly what it sounds like: a single rate applied to the final sale price, no matter how high or low that price is. Simple, predictable, and dead easy to calculate.

Here’s the formula: Sale Price x (Commission Rate / 100) = Commission Fee

Let's plug in some real-world numbers to see how it works:

- For a $750,000 property sale with a 2.2% commission rate:

- $750,000 x 0.022 = $16,500

- For a $1.2 million property sale with a 1.9% commission rate:

- $1,200,000 x 0.019 = $22,800

This model is popular, but it's not the only game in town. Many agents, especially in competitive markets, prefer a tiered structure to give them an incentive to push for a higher sale price.

Demystifying The Tiered Commission Structure

A tiered, or sliding scale, commission is all about motivating your agent to smash a certain price goal. With this setup, the agent gets a base percentage up to an agreed-upon price, then a higher percentage on any amount they get above that line.

This approach is a big deal in Australia because it puts the agent's financial interests squarely in line with yours. It’s why having a flexible real estate commission calculator is so handy for getting an accurate forecast. For instance, an agent might charge 2% on sales up to $500,000, jumping to 2.5% on the part of the sale between $500,000 and $1 million. Knowing these brackets is everything.

Let's walk through a practical example:

An agent proposes a commission of 2.5% on the first $800,000 of the sale price and a juicy 3.5% on any amount above that. Your property ends up selling for $850,000.

Here’s how you'd work out the total commission:

- Calculate the base commission: $800,000 x 0.025 = $20,000

- Calculate the bonus commission: ($850,000 – $800,000) x 0.035 = $50,000 x 0.035 = $1,750

- Add them together: $20,000 + $1,750 = $21,750

The Final Step: Adding GST

The last, and often forgotten, piece of the puzzle is the Goods and Services Tax (GST). Here in Australia, GST is 10%, and it's applied to the agent's commission fee—not the total sale price of your property.

If you’re focused on your net proceeds, that’s a massive distinction. It's just like how sharp investors use a rental property ROI calculator to factor in every single expense for a true picture of profitability.

Let’s calculate the final payable amount for our tiered example above:

- Commission Fee: $21,750

- GST Calculation: $21,750 x 0.10 = $2,175

- Total Payable Commission: $21,750 + $2,175 = $23,925

That final figure, $23,925, is the amount that will be deducted from your sale proceeds at settlement. No more surprises.

Don't Forget the "Other" Costs That Eat Into Your Profit

Getting a great sale price is one thing, but what you actually walk away with is a completely different story. While the agent's commission is usually the biggest chunk, a handful of other expenses will definitely make a dent in your final profit. Forgetting about these can lead to some nasty surprises and a lot of stress come settlement day.

Thinking about these costs from the get-go is the difference between having a solid financial plan and scrambling at the last minute.

Common Seller Expenses to Factor In

So, beyond the agent's cut, what else should you be budgeting for? These are the typical costs you'll need to cover for a smooth, successful sale. They can vary a bit depending on where you are and the type of property you're selling, so it's always smart to get a few quotes early on.

Here’s a quick rundown of what to expect:

-

Marketing and Advertising: This isn't part of the commission; it's the separate budget for your sales campaign. Think professional photos, floor plans, online listings on the big portals, signboards, and brochures. You could be looking at anywhere from $800 to $10,000, depending on how big you go with the campaign.

-

Legal and Conveyancing: You'll need a solicitor or conveyancer to handle all the legal paperwork for transferring ownership. They prep the contract of sale and manage the whole settlement process. Budget between $1,200 and $2,500 for their fees.

-

Home Staging and Minor Touch-Ups: First impressions are everything in real estate. Many sellers bring in professional stagers ($2,000 – $8,000+) or just do some minor repairs like patching walls and a fresh coat of paint to get the best possible price. You'd be surprised how much return you can get from a few small fixes.

To get a really clear idea of what you'll pocket, you need to tally up all these expenses. A good Property Selling Cost Calculator can be a lifesaver for itemising everything properly.

How to Calculate Your Net Proceeds: A Real-World Example

Alright, let's put it all together with a hypothetical sale in Sydney. Seeing the actual numbers makes it much easier to picture your final payout. A real estate commission calculator is great for figuring out one piece of the puzzle, but this bigger picture is what really counts.

Keep in mind that commission rates can be all over the place. In Sydney, intense competition has seen the average commission drop to between 1.66% and 1.84%. Head out to a regional hub like Broken Hill, though, and the average is closer to 3.23%.

Let's run the numbers for a Sydney property:

| Net Proceeds Calculation Sheet (Example) | |

|---|---|

| Final Sale Price | $1,100,000 |

| Less Outstanding Mortgage | -$450,000 |

| Less Agent Commission (1.8% + GST) | -$21,780 |

| Less Marketing Fees | -$4,500 |

| Less Conveyancing Fees | -$2,000 |

| Estimated Net Proceeds (Cash in Hand) | $621,720 |

This kind of breakdown gives you the true financial outcome. Nailing these costs is crucial, and on a related note, improving your property management efficiency can also make a huge difference to your overall real estate finances.

How to Actually Negotiate Your Agent's Commission

Here’s a little secret many home sellers don’t quite grasp: an agent’s commission is almost always up for discussion. That first rate they quote? It’s not set in stone. A bit of confident, well-informed negotiation can literally save you thousands of dollars.

The trick is to walk into that conversation from a position of strength, armed with solid market knowledge and a clear idea of what you want. You're hiring someone for a hugely important job, so don't be shy about treating it like a business deal.

Create a Bit of Healthy Competition

Before you even get to the numbers, you need to set the stage. The single best way to do this? Interview at least three different agents.

When agents know they’re competing for your listing, they’re naturally more inclined to bring their A-game. That means a sharper commission rate and a more impressive marketing plan. It’s simple business sense.

Once you’ve done your research on local commission rates, you can use that as your anchor. When an agent tables their fee, you can respond with something like:

"Thanks for that. From what I’ve seen with recent sales around here, the average seems to be closer to X%. Could you walk me through what extra value your service brings to justify the higher fee?"

This isn’t about being confrontational. It shows you’ve done your homework and neatly pivots the chat from just price to the actual value and service you're getting for your money.

Play to Your Property's Strengths

Got a house in a hot-ticket suburb? Is it a high-value property that will land the agent a hefty commission even at a slightly lower percentage? These are your bargaining chips – use them.

Make sure you point out the best features of your property that make it an easier, more attractive sale. You could say something like, "Given the home's prime spot and the way the market's moving, I'm expecting it to get a lot of interest fast. That should probably be reflected in the commission structure, don't you think?"

Another savvy move is to propose a tiered commission. You could suggest a lower base rate that kicks up to a higher bonus percentage if the agent smashes a specific, ambitious sale price. This gets their financial goals locked in right alongside yours and gives them a real incentive to shoot for the moon.

Know When to Spot a Red Flag

While negotiating is smart, you need to be a bit wary of an agent who drops their rate at the first sign of a pushback. If an agent doesn't have the confidence to negotiate their own fee, how can you trust them to negotiate the best possible price for your home?

Here are a few signs an agent might be slashing their rate for the wrong reasons:

- They fold instantly: They agree to your lowball offer without even a token discussion about their value.

- Their promises are vague: They can’t clearly explain what makes their marketing or negotiation strategy stand out from the pack.

- They have no recent runs on the board: They can't show you a portfolio of recent, successful sales in your area to back up what they're saying.

At the end of the day, the goal isn't to find the cheapest agent, but the one who delivers the best value. A brilliant agent who gets you a higher sale price is worth a slightly higher commission, every single time. A good real estate commission calculator is your best friend here, as it can help you crunch the numbers on these different scenarios to see exactly how it all shakes out in your pocket.

How To Use A Commission Calculator For Smart Planning

A real estate commission calculator is more than just a tool for crunching the final numbers; it's a strategic weapon for smart financial planning. It’s what helps you move from ballpark figures to concrete numbers, giving you the clarity you need to make savvy decisions well before you even list your property.

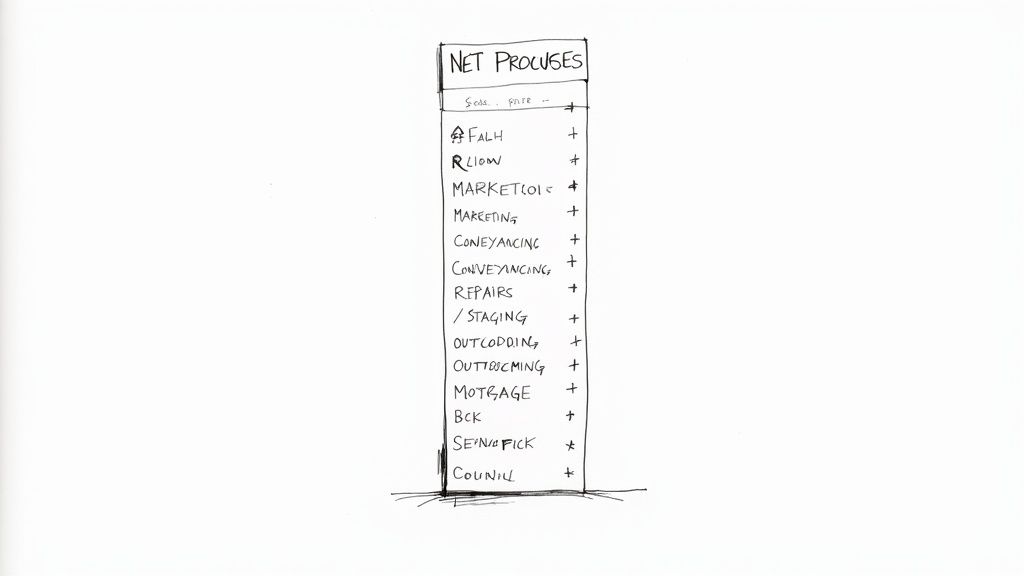

This sketch nails it. Seeing abstract percentages turned into tangible dollar figures is exactly how you should be thinking about the process.

Running Different Scenarios

The real magic of a calculator is its power to run multiple scenarios in seconds. Instead of just wondering how a slightly different commission rate might affect your bottom line, you can see it laid out in black and white. This is incredibly helpful when you're comparing different agents.

Let's take a real-world example. Say you have a property with an expected sale price of $900,000.

- Agent A quotes 2.0%: The commission (excluding GST) comes to $18,000.

- Agent B quotes 2.5%: The commission (excluding GST) jumps to $22,500.

That tiny 0.5% difference means an extra $4,500 coming directly out of your pocket. Seeing that cold, hard figure helps you ask the right questions. Is Agent B's marketing plan or negotiation prowess really worth that much more? This sort of data-driven insight is invaluable. For anyone serious about property, learning to use a real estate investment calculator is another fantastic skill for getting these kinds of actionable insights.

When you run these comparisons, you're not just talking about fees anymore. You're framing the conversation around the total value an agent brings to the table, and you're doing it with solid financial data, not just a gut feeling.

Key Features to Look For in a Calculator

Not all calculators are built the same. To get the accuracy you need for proper planning, make sure the tool you're using reflects how agency agreements actually work here in Australia.

A decent real estate commission calculator should be able to:

- Automatically include GST: The final fee always has GST tacked on. Your calculator must do the same, or you’ll instantly underestimate your costs by 10%.

- Handle tiered commission structures: Many of the best agents use tiered rates to incentivise a higher sale price. A calculator that can't handle that complexity won't give you an accurate estimate.

- Be dead simple to use: You should be able to plug in the sale price and commission rate and get an immediate, clear result. No fuss.

Ultimately, this simple tool demystifies one of the biggest costs of selling your home, allowing you to budget with confidence. It's just one of the many digital tools making an agent's life easier these days. You can check out more in our guide to the best apps for real estate agents.

Got Questions About Real Estate Commissions?

Even after you've crunched the numbers, a few questions can still linger. It’s a big chunk of money, so getting total clarity before you sign on the dotted line is non-negotiable. Let's tackle the most common queries we hear from sellers.

Are Real Estate Commissions Negotiable In Australia?

Yes, they absolutely are. In Australia, an agent's commission is never set in stone and is almost always up for discussion. Think of the first number they throw out as the start of a conversation, not the final word.

Your real power here comes from doing your homework. The trick is to interview at least three different agents—it creates a bit of healthy competition. You should also arm yourself with the average commission rates for your specific suburb so you can walk in and discuss your expectations calmly and confidently. It shows you're a serious seller who knows the market.

Who Actually Pays The Agent's Commission?

The seller is always the one who pays the agent's commission. But—and this is a big but—it's not an upfront cost you need to have sitting in your bank account.

The total commission fee (including GST) is simply taken out of the sale proceeds when the property settles. Your solicitor or conveyancer manages this whole process, making sure the agent is paid from the buyer's funds before the rest of the cash lands with you. It’s a structure that makes the whole thing a lot more manageable.

Key Insight: The commission comes out of the profit from your sale, not your personal savings. That’s a crucial detail for anyone trying to budget and manage their cash flow through the selling process.

Are Marketing Costs Included In The Commission Fee?

Nope. Marketing and advertising costs are almost always a separate expense that the seller covers. This is a classic point of confusion, so it's something you need to clarify with any agent you're considering. The commission pays for the agent's service, expertise, and time—not for the ad campaign.

These marketing funds cover essentials like professional photography, listings on the big portals like Domain and realestate.com.au, the 'For Sale' board out the front, and any printed flyers. Always, always ask for a detailed, itemised breakdown of all proposed marketing fees in the agency agreement before you sign anything. You don't want any nasty surprises later on.

How Is The Commission Split Inside The Agency?

When you hand over that commission, the money doesn't just go into one person's pocket. The total fee is typically carved up between a few different people within the real estate agency.

Usually, the commission gets split between:

- The listing agent who brought you on as a client and managed the sale.

- The selling agent (if it's someone different) who actually found the buyer.

- The real estate agency itself, to cover overheads, admin, and support.

How they split it internally is their business and doesn't change the total amount you pay. Whether it's one agent or a whole team working on your sale, the final commission you agreed to is what you'll pay. Your job is to focus on that total percentage and the value you're getting for it.

Ready to stop missing calls and start converting more leads effortlessly? OnSilent is the AI personal assistant that answers every call, qualifies enquiries, and nurtures your leads 24/7, so you can focus on closing deals. Reclaim your time and never lose a lead again by starting your free trial today.