At its core, property management accounting software is a specialised financial tool built specifically for the unique demands of real estate. Unlike generic accounting programs, it’s designed to juggle rent collection, track expenses for individual properties, and handle owner payouts, all within one tidy system.

Your Financial Control Centre for Real Estate

Trying to manage your property portfolio's finances with a standard spreadsheet is a bit like trying to navigate a bustling city with a map you drew by hand. Sure, you might get there eventually, but it’s clumsy, slow, and you’re bound to make a few costly wrong turns.

Property management accounting software is the modern-day GPS every real estate professional needs. It becomes the financial nerve centre of your entire operation, creating a single, reliable source of truth for every dollar that comes in and goes out.

Think about it this way: a standard tool like Xero or MYOB is fantastic for general business bookkeeping. But it just doesn't get the complex relationship between a tenant, a property, and an owner. It can't easily handle trust accounts or automatically slice up a rent payment into management fees, maintenance costs, and what’s left for the owner.

That’s where the magic really happens. This software is purpose-built to untangle the multi-layered financial web that defines property management, from the moment rent hits your account to the final owner disbursement.

Why Specialised Software Matters

The need for these specific tools isn't just a "nice-to-have"—it's becoming essential, especially in Australia’s booming real estate market. The Aussie property management scene was valued at roughly USD 8.1 billion in 2024 and is expected to climb to around USD 11 billion by 2033. This growth is being driven by a surge in rental demand and investment, which puts immense pressure on property managers to be more efficient and compliant. You can get a deeper dive into these market trends over at imarcgroup.com.

More growth means more properties, more tenants, and a whole lot more financial data to keep straight. Let’s be honest, manual methods just can't keep up.

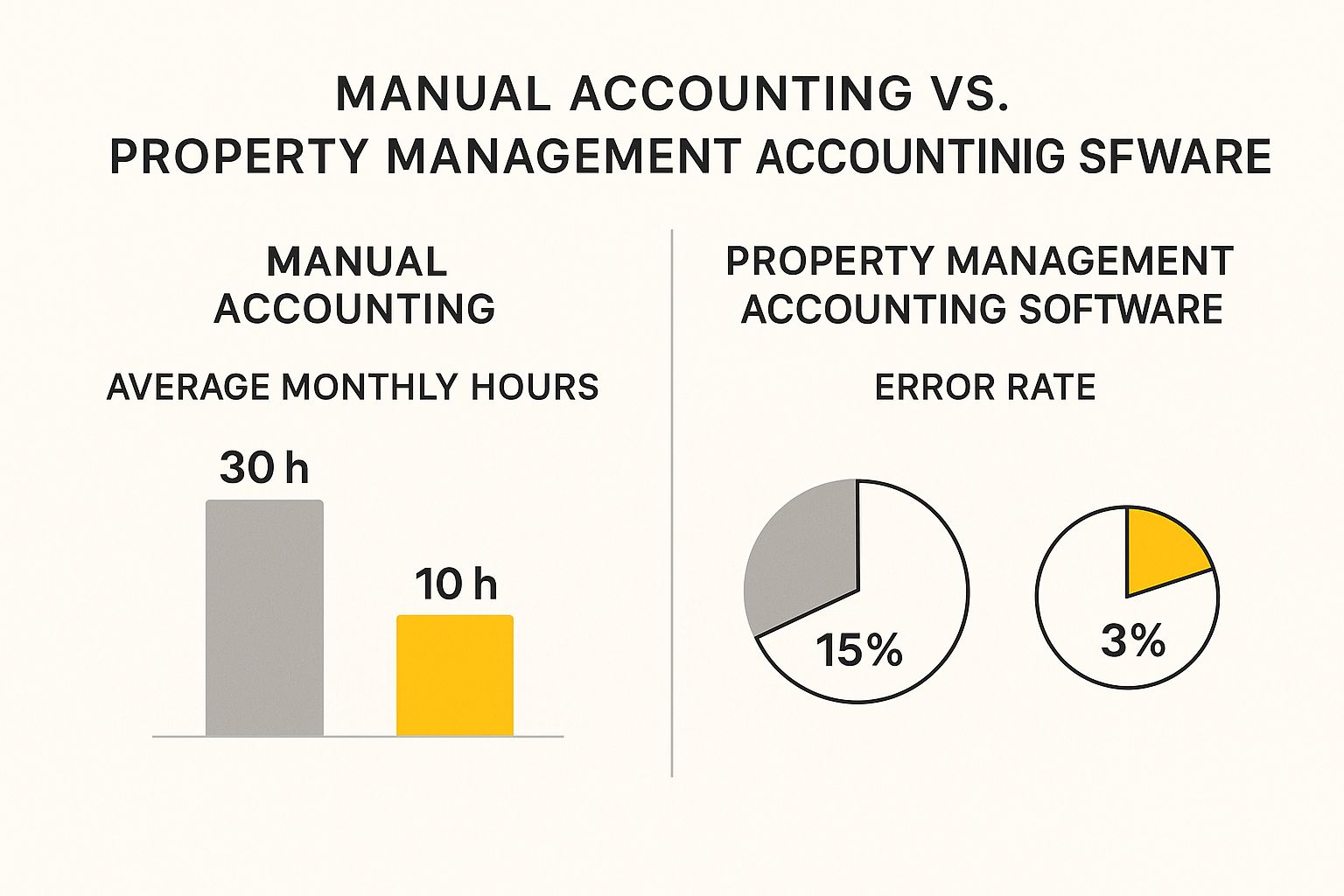

This infographic paints a pretty clear picture of the difference it makes when you ditch the old ways for dedicated software.

The numbers speak for themselves. You get a huge boost in efficiency, freeing up your team to focus on growing the business instead of getting bogged down in administrative quicksand.

To really understand the difference, let’s break down how these systems stack up against each other.

Standard Accounting vs. Property Management Accounting Software

Here’s a quick comparison to highlight why a generic solution often falls short for property management.

| Feature | Standard Accounting Software (e.g., Xero, MYOB) | Property Management Accounting Software |

|---|---|---|

| Core Structure | Organises finances around a single business entity. | Organises finances by property, owner, and tenant. |

| Trust Accounting | Lacks built-in, compliant trust accounting features. | Designed for strict trust accounting regulations. |

| Rent Collection | Can create invoices, but lacks automated tracking and fee logic. | Automates rent invoicing, payment reminders, and late fees. |

| Expense Allocation | Can track expenses, but not easily assigned to specific properties. | Allows for direct allocation of costs to individual properties. |

| Owner Payouts | Requires manual calculations and reporting for owner disbursements. | Automates owner statement generation and payouts. |

| Reporting | Standard business reports (P&L, Balance Sheet). | Specialised reports (rent roll, owner statements, vacancy rates). |

As you can see, while standard software is great for many businesses, it simply isn’t built with the DNA of property management in mind.

Core Functions of Property Management Accounting Software

At its heart, this software organises your entire financial world around individual properties and their owners, not just one business P&L. This structure gives you incredible clarity and control. Here are the key things it does:

- Trust Accounting and Compliance: It automatically keeps tenant, owner, and business funds separate to meet strict legal requirements, making audit time far less of a headache.

- Automated Rent and Fee Collection: The system sends invoices, chases up payments, and slaps on late fees automatically, leading to much more predictable cash flow.

- Expense Tracking by Property: You can pin every single maintenance invoice or water bill to a specific property, giving you a crystal-clear view of each asset's profitability.

- Owner Statement Generation: It takes the pain out of creating detailed financial reports for your property owners, clearly laying out all the income and expenses tied to their investment.

Core Features That Drive Operational Efficiency

While having a specialised financial system sounds good on paper, its real magic is in the specific features that turn daily chaos into calm, organised success. These are the workhorse components of property management accounting software that have a direct, daily impact on your team's capacity, your bottom line, and how happy your clients are.

Think of these features as the engine room of your agency. Each part is built to handle a specific, often frustrating task, freeing up your team to focus on growing the business and looking after clients instead of getting bogged down in repetitive admin.

Let's pull back the curtain on the essential tools that make modern property management not just possible, but profitable.

Automated Rent and Late Fee Processing

The most basic job in property management is collecting rent, but it's often the one that chews up the most time. Manually sending invoices, chasing up payments, and following up on overdue accounts is a constant drain on your resources.

This is where automated processing completely changes the game. The software acts like a tireless financial assistant, automatically firing off rent invoices on schedule. If a payment is late, you can set it up to add a late fee and send a reminder without anyone having to lift a finger.

This automation gives you predictable cash flow, cuts down on those awkward phone calls with tenants, and makes sure your revenue cycle runs like a well-oiled machine. Sticking to manual financial tasks isn't just inefficient; it's a breeding ground for costly mistakes that can hurt your reputation and your bank account.

Tenant and Owner Portals for Transparency

A huge chunk of any property manager's day is spent answering questions from tenants and owners. Tenants want to check their payment history or log a maintenance request, while owners are after updates on how their property is performing financially.

Integrated portals give both groups a central, self-service hub to get what they need, when they need it. Tenants can log in to see their ledger, pay their rent, and submit maintenance requests with photos. At the same time, owners can access real-time financial statements, check on approved invoices, and see the status of their property.

By giving them this direct window into your operations, you build trust and massively cut down the number of phone calls and emails flooding your inbox. This kind of transparency is a key advantage that makes your clients feel valued.

Robust Financial Reporting and Analytics

You can't make smart business decisions without clear, accurate data. Your standard accounting software might spit out a basic profit and loss statement, but it just can't give you the detailed insights needed to properly manage a property portfolio.

Specialised software, on the other hand, comes loaded with a suite of reports built just for you.

- Rent Roll: Instantly see who has paid, who is overdue, and your total rental income for any period.

- Owner Statements: Generate professional, easy-to-read reports that clearly break down all the income and expenses for each owner.

- Property Performance: Dig into the profitability of individual properties or your entire portfolio to spot which assets are your star performers and which ones might need a bit more attention.

This level of insight is becoming non-negotiable. The global property management software market, where Australia is a major player, is expected to generate around USD 1.5 billion in Q1 of 2025 alone. Aussie firms are jumping on these platforms to get a competitive edge with data-driven decisions. To get the full picture on this global trend, you can read the report about the property management software market on wkinformation.com.

Integrated Maintenance Management

Finally, connecting maintenance requests directly to your financial ledger is a game-changer. When a tenant reports an issue through their portal, you can create a work order, assign it to a tradie, and track it right through to completion.

Once the invoice from the tradesperson comes in, it can be approved and paid directly from the system. This automatically assigns the expense to the right property and shows up on the owner's statement. It creates a perfect audit trail and gets rid of the risk of mixing up costs. It’s a foundational piece for boosting your overall property management efficiency.

The Financial Benefits of Investing In Proptech

Let's move past the features and talk about what really matters: your bottom line. It's easy to see property management accounting software as just another business expense, but that's the wrong way to look at it. Think of it as a direct investment in your agency's profitability. This tech is a powerful tool for whipping your agency’s finances into shape, delivering a clear return by sharpening everything from daily tasks to your long-term game plan.

The most obvious win comes from automation. Just think about all those hours your team sinks into repetitive admin—chasing rent, calculating fees, and cobbling together manual reports. That’s precious time they could be spending on things that actually grow the business, like landing new management agreements or building stronger relationships with owners and tenants.

By taking those tedious financial jobs off their plate, the software directly cuts your administrative overhead. It frees up your best people to focus on high-value work, turning what was once a cost centre into a genuine growth engine.

Protecting Your Bottom Line with Accuracy

Let's be honest, managing finances manually, especially with spreadsheets, is a minefield of potential errors. A single typo or a dodgy formula can lead to incorrect owner payouts, messy tax filings, or even a breach of trust accounting rules. These aren't just minor hiccups; they can trigger hefty financial penalties and do serious damage to your professional reputation.

This is where specialised accounting software acts as your financial guardian.

- Minimises Compliance Risks: It automates the tricky calculations for things like owner disbursements and service charges, ensuring everything is spot-on and consistent.

- Creates Audit-Ready Trails: Every single transaction is logged and tracked, giving you a clear, unchangeable record that makes audit time far less of a headache.

- Enhances Financial Reporting: The system pumps out precise, reliable reports, so all your stakeholders—from property owners to the tax office—get the accurate info they need. Keeping organised records also makes it much easier to maximise your claims. To learn more, check out our guide on rental property tax deductions.

This level of accuracy stops expensive mistakes before they can happen, shielding your agency from compliance nightmares and keeping that all-important trust with your clients intact.

Accelerating Revenue and Unlocking Growth

Beyond just preventing losses, the right software actively helps you bring in more money, faster. When rent collection is streamlined with automated reminders and late fees, you get paid on time, which massively improves your cash flow. That consistency is the lifeblood of a healthy agency.

On top of that, integrated vacancy management tools help you shrink the time properties sit empty. By getting vacancies advertised sooner and processing applications more efficiently, you can shorten those costly turnover periods. Over a year, that adds up to a lot more rental income.

But the real strategic edge? It's in the analytics. The software doesn't just store data; it helps you make sense of it. You can instantly spot which properties in your portfolio are lagging and figure out why.

For instance, you might notice one property is racking up unusually high maintenance costs, giving you a reason to investigate. Or you could analyse rental trends in a specific suburb to find opportunities to adjust the rent, making sure your clients’ assets are always working as hard as they can. This data-driven approach lets you make smarter, more profitable decisions and transforms you from a simple manager into a strategic asset advisor for your clients.

How to Choose the Right Software for Your Portfolio

Choosing the right property management accounting software can feel like a massive task, but breaking it down into a few logical steps makes it much more manageable. The real goal isn't just to find any solution, but to find the perfect fit for your specific portfolio and where you want your business to go.

Think of it like buying a vehicle. A courier zipping through the city delivering small parcels has completely different needs to a construction company hauling heavy gear. Both need transport, sure, but the right choice boils down to the job at hand. The exact same logic applies here.

Let's walk through a practical framework to help you make a confident, smart decision that will serve your agency for years to come.

Define Your Portfolio's Unique Needs

First things first, you need a crystal-clear picture of your current portfolio. The software needs of a manager looking after 20 residential units are a world away from an agency juggling a mixed bag of commercial, residential, and industrial properties. Don't get sidetracked by flashy features you'll never actually use.

Start by asking some honest questions:

- Portfolio Type: Are you managing residential, commercial, or a bit of both? Commercial properties often come with complex lease terms and service charge calculations that demand specialised features.

- Portfolio Size: How many properties and units are you really managing right now? Be realistic about your scale.

- Team Size: How many people in your agency will need to use the software? Think about everyone, from your accounts team to the property managers out in the field.

- Biggest Pain Points: What are the top three administrative headaches your team battles every single week? Is it chasing up late rent, wrestling with trust account reconciliations, or getting owner statements out on time?

Your answers will create a sharp profile of what your day-to-day operation actually looks like. This profile is your blueprint for assessing different platforms, making sure you only focus on options that solve your real-world problems.

Prioritise Scalability and Future Growth

The software you pick today has to support the business you want to be tomorrow. A platform that runs smoothly with 50 properties might start to crack under the pressure of 250. You need a solution that can grow with you, not one that will hold you back.

A classic mistake agencies make is choosing software for the business they have now, not the one they’re trying to build. True scalability means the software can handle more properties, more users, and more transactions without slowing down or hitting you with a massive price jump.

When you're talking to vendors, ask them directly about their pricing tiers and how they support growing businesses. A scalable solution should offer a clear upgrade path, letting you add more features or capacity as your portfolio expands. A bit of foresight now can save you the massive headache and expense of migrating to a whole new system in just a couple of years.

Evaluate Key Criteria for a Perfect Fit

Once your needs are defined, you can start weighing up potential software against a core set of criteria. This is where you separate the real contenders from the rest of the pack.

Zoom in on these three critical areas:

- Integration Capabilities: Your accounting software doesn't live on an island. It needs to play nicely with the other tools you rely on, like your CRM, inspection apps, and maintenance platforms. Strong integrations automate your workflows and create a single source of truth across your entire operation.

- User-Friendliness and Team Adoption: The most powerful software in the world is useless if your team finds it too clunky to use. Look for a clean, intuitive interface. User adoption is everything; if the platform isn’t easy to pick up and navigate, your team will just find workarounds, and your investment will be wasted.

- Customer Support Quality: When things go wrong—especially with something as critical as trust accounting—you need fast, expert support. Do your homework on the provider's reputation for customer service. Do they offer phone support, live chat, or just email tickets? What are their hours? Great support isn't a "nice-to-have"; it's a non-negotiable.

Finally, always, always take full advantage of free trials and demos. This is your chance to test-drive the platform with your real-world scenarios. Make a checklist of your "must-have" functions and put each one through its paces. Input a couple of test properties, generate an owner statement, and try to log a maintenance request. This hands-on experience is the single best way to know for sure that you've found a perfect fit for your agency.

Navigating Trust Accounting and Compliance

In the tightly regulated world of real estate, staying compliant isn't just a good idea—it’s a legal must-have. For any property manager, handling trust money is one of the most serious responsibilities you'll ever have. This is where modern property management accounting software shifts from being a simple tool to your tireless digital compliance officer.

Think of a trust account as a locked box. Inside, you're holding other people's money—rent from tenants, funds for maintenance, and security deposits. Mixing this money with your own business funds isn't just sloppy; it's a huge breach that can come with some pretty severe penalties. Trying to keep it all separate manually is a high-stakes, stressful balancing act.

The right software automates this entire headache. It’s built from the ground up to understand the ins and outs of trust accounting rules, creating separate digital ledgers for every single property owner. When rent lands in the account, the system automatically carves it up, allocating funds to the owner, your management fee, and any held expenses. The risk of human error? Pretty much gone.

Demystifying Audits and Reconciliations

Just hearing the word "audit" can send a shiver down the spine of even the most experienced property manager. But with the right system in place, getting ready for one becomes a straightforward, low-stress job. The software meticulously logs every transaction, creating a bulletproof audit trail that can't be altered.

This means you can generate audit-ready reports at a moment's notice, clearly showing where every cent came from and where it went. Bank reconciliations, a notoriously tedious monthly chore, are often automated or at least semi-automated. Your software matches transactions from the bank feed to your trust ledger, flagging any odd ones out instantly.

This takes reconciliations from a multi-hour headache to a quick review. It gives you, your clients, and the auditors total confidence that your books are spot-on and fully compliant with state regulations.

Beyond Trust Accounts to Broader Compliance

Regulatory compliance and keeping risk low are massive drivers behind the uptake of property management accounting software in Australia. These platforms are packed with tools that help managers meet fair housing laws, data protection standards, and other legal hurdles that just seem to get stricter. For a deep dive into what's pushing the market, you can find more insights on the property management software market at futuremarketinsights.com.

This goes way beyond just trust accounts. Good software helps you stay on top of other critical obligations:

- Compliant Owner Statements: It automates clean, detailed end-of-year financial statements for your property owners, making sure they have the accurate info they need for their tax returns.

- Tax Tracking and Remittance: The software can accurately track GST on your fees and other taxable items, which massively simplifies calculating and sending off what you owe to the Australian Taxation Office (ATO).

- Secure Record Keeping: By keeping all financial documents and messages in one central, secure spot, the software helps you tick all the boxes for data privacy and record-keeping laws.

This all-encompassing approach to compliance also touches on how you manage your client interactions. Keeping track of every conversation is vital for heading off disputes and maintaining a clear record. Having a solid system for this is just as essential as using a professional property management answering service to ensure no important call or message ever gets missed.

Ultimately, this technology delivers genuine peace of mind. It doesn't just lighten your daily workload; it acts as a powerful shield, seriously cutting down the risk of costly financial penalties and the reputational hit that comes with them.

Right, you've picked your new property management accounting software. High five! But the journey isn't over—in fact, the most important part is just beginning. Getting the implementation right is the bridge between your old, clunky ways and a future of smooth, efficient operations. A bit of planning here makes all the difference, ensuring you hit the ground running.

Think of it less like flipping a switch and more like a well-planned renovation. You wouldn't knock down all the walls at once, right? The same goes here. A step-by-step transition minimises chaos and helps your team feel confident with the new tools from day one. Let's walk through the key stages to make it a success.

Getting Your Data Migration Right

First up is the big one: moving all your financial records. This means getting everything from old spreadsheets or a previous system into your shiny new platform. Don't rush this. Clean, accurate data is the bedrock of your new system, and getting this step right will save you a world of pain later on.

To make sure it's a clean transfer, follow these steps:

- Scrub Your Data First: Before you even think about moving anything, it's time for a deep clean. Fix typos, hunt down and delete duplicate entries, and make sure every bit of information is complete and up-to-date.

- Do a Test Run: Most software providers will let you do a trial migration with a small chunk of your data. This is gold. It’s your chance to spot any weird glitches or formatting issues before you commit to moving everything.

- Check Everything Afterwards: Once the data is in its new home, it’s time to play detective. Do some spot-checks, run a few reports, and confirm everything landed where it should. Double-check tenant ledgers, owner details, and property info to be sure nothing got lost in translation.

A classic mistake is thinking data migration will be quick and easy. Trust me, it won't be. Always budget more time than you think you need. A rushed migration almost always creates a mess of data errors that can take weeks to fix.

Nailing Team Training and Adoption

Even the most amazing software is just an expensive paperweight if your team doesn't know how to use it. Proper training is what turns a software purchase into a real-world solution. Don't just tick the box with a single one-hour session; think about ongoing support and making your team feel empowered.

A great move is to pick one or two "super users" on your team. Give them extra, in-depth training so they can become the go-to experts for their colleagues. This kind of peer support is incredibly effective. Research shows that agencies with strong user adoption get a return on their tech investment much, much faster.

You might also want to consider a phased rollout. Instead of launching everything at once and causing a meltdown, start small. Maybe roll it out to a handful of properties first, or focus on a single core task like rent collection. This lets your team build confidence and gives you a chance to gather feedback and smooth out any kinks before going agency-wide.

Got Questions? We've Got Answers

Diving into the world of property management accounting software can definitely bring up a few questions. It’s a specialised bit of kit, after all. Here, we’ll tackle some of the most common queries we hear, giving you straight-up, practical answers without the confusing jargon.

Think of this as your quick guide to getting the fundamentals right, whether you're just starting to look around or you're on the verge of picking a new system for your agency.

How Is This Different From Standard Accounting Software?

Great question. The biggest difference is its very DNA. Standard software like Xero or MYOB is built to manage the books for one single business. But in property management, you're juggling the finances for multiple parties—the tenant, the property, and the owner—all at once.

Your everyday accounting software just isn't wired for that. Property management platforms have purpose-built features for things like trust accounting, owner disbursements, and tracking expenses for each individual property. Trying to do this with generic software is like asking a GP to perform brain surgery; they're both doctors, but you absolutely want the specialist for a complex, specific job.

Can Small Portfolios Benefit From This Software?

Absolutely. It’s a common misconception that this is only for the big players. Even if you're managing a small portfolio of 5-10 properties, you'll feel the benefits almost immediately. Think of the time you'll get back by automating rent reminders, making bank reconciliations a breeze, and whipping up professional owner statements in a few clicks.

But here’s the real kicker: it helps you build good habits and compliant processes from day one. You’re laying a rock-solid, scalable foundation, which makes growing your portfolio down the track a whole lot easier. No more hitting an admin wall when you start to expand.

It’s all about working smarter, not harder, no matter the size of your rent roll.

Is This Software Difficult To Learn?

Not like it used to be. Modern property management accounting software is designed with real people in mind. Sure, any new system has a bit of a learning curve, but most good platforms today have intuitive layouts, guided setup wizards, and stacks of training resources like video tutorials and support articles.

Many agencies find that after a bit of initial training, their teams get the hang of it pretty quickly. Why? Because the software’s workflow is designed to mirror the tasks they already do every single day. The best way to know for sure is to take a few options for a spin with a free trial. And don't underestimate the value of top-notch customer support—it can make the transition a whole lot smoother.

Are you tired of losing track of important calls from potential tenants and property owners? OnSilent organises your communications, filters out spam, and ensures you never miss a critical message again, saving you hours every week. Take control of your calls today with OnSilent.